Description

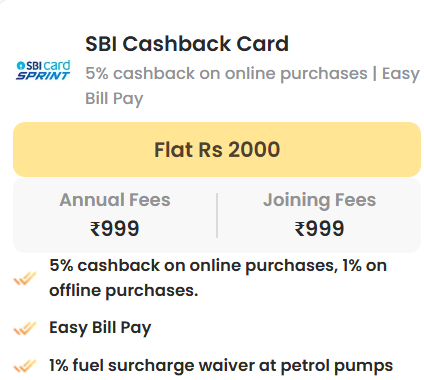

Fees:

- Joining Fee: Rs.999

- Renewal Fee: Rs.999 (Waived with Rs.2 lakh annual spend)

- Cash Advance Fee: 2.5% or Rs.500

- Finance Charges: 3.50% per month (42% p.a.)

- Late Payment Fee: Varies based on outstanding amount.

Additional Charges:

- Overlimit Fee: 2.5% or Rs.600

- Payment Dishonor Fee: 2% of payment amount (min Rs.500)

- Rewards Redemption Fee: Rs.99

- Cheque Payment Fee: Rs.100

- Card Replacement Fee: Rs.100 to Rs.250

- Foreign Currency Transaction Fee: 3.5% (1.99% for Aurum and Elite)

How it works?

Applying for Cashback SBI Card:

- Go to the ‘Credit Cards’ page and choose ‘Cashback SBI Card.’

- Click ‘Apply Now’ and fill in the online application form.

- Submit the form.

- Upon approval, SBI Card team will contact you for verification.

- Receive your Cashback SBI Card after verification.

Eligibility Criteria:

- Age: 21 to 70 years

- Salaried or self-employed professional

- Good credit score

- Regular source of income